Spend For Glory Or Reserve Wastefully: Asymmetric Gain & Loss Recognition

By

Anthony Hene and Professor Michael Mainelli

Published by Charity Finance, pages 28-30.

Spend or Save?

Determining spending levels is one of the most important decisions facing decision-makers in Non-Governmental Organisations (NGOs, including organisations such as charities, trades unions, trusts or foundations). While many NGOs have a “reserves policy”, how many have a “spend policy”? Expenditure and retention decisions are a delicate trade-off among three aims:

- the desire to provide services or grants;

- the desire to ensure service continuity, by having appropriate reserves;

- the need to meet the organisation’s objectives.

The last of these aims is the most important, for that is the mission of the NGO. Yet sadly, long-term objectives are frequently subordinate to providing current services or grants (i.e. maintaining the status quo) and ensuring survival, when objectives might sometimes be better met by spending aggressively today. Donors do not, in the main, give charities monies to ensure survival. Donors give charities money to take risks that would otherwise not be taken by commercial organisations or government. There are even cases where objectives have been met or overtaken and the NGO might better wound up or reincarnated, yet the “safe” decision seems to be to increase already substantial reserves.

Given the complexity of the decisions on expenditure and retention, an ad hoc approach or once-a-year trustee meeting is not sufficient. NGOs need a linked “spending and reserves” policy. The development and use of an explicit spending and reserves policy ensures that decision-makers understand the financial basis on which the ongoing work of their organisation rests. Fully thinking through these issues could be the difference between ensuring a robust future, a slow decline, a not-so-slow decline or somnolescence.

Assuming the Honourable Risk of Default

In essence, the spending and reserves equation for an NGO is simple:

BUDGETED INCOME + INCOME FROM INVESTMENTS

- BUDGETED COST - TAKEN TO RESERVES = 0

Much has been written about the mechanics of budgeting income and budgeting cost. However, the strategy of budgeting income and budgeting cost is rarely founded on an equally important principle, “risk of default”. As stated earlier, donors give monies so that a charity takes risks on behalf of society, not for the continuation of the organisation. There are a few exceptions to this principle, for instance NGOs working on preservation or lineage, but even venerable charities will find that their charitable objectives do not include “preserving jobs for our staff” or “ensuring the continuation of the organisation”. Too frequently, NGOs look at reserves in terms of a number of months’ operation, e.g. “reserve cover”, e.g. 6 months’ running costs. This seductive simplicity belies the complexity of reserving for closure, prudence, budgeted change, special projects, unexplained variability or capital funding.[1] In order to relate spending to reserves, most NGOs should require a statement to the effect that “our reserves calculations are based on a potential financial failure once in every X years” where X may well be high, e.g. 100 years, but far more likely ought to be frighteningly low to a trustee, e.g. once in every 10 or 25 years.

Commercial organisations knowingly run the risk of default. Shareholders and creditors are alert to potential insolvency and price accordingly. Shareholders punish firms that keep reserves too high - they are not acting in the interests of the shareholders. Firms have no reason to exist in perpetuity without producing appropriate returns for shareholders. For firms, read NGOs; for shareholders, read beneficiaries. The Charity Commission is fairly clear: “contingency funding can normally only be justified as provision for identified and quantified expected demands rather than mere uncalculated possibilities, fears and rumours.” In the USA, Senator Bill Bradley even argues that, on balance, charities have a duty to society to spend today rather than tomorrow[2], “the impact of the foundation is thus diluted by the decision to distribute its funds slowly”, although his numerical arguments are a bit short-term and short-sighted.

Income from Investment

Having established the risk of default (reserve levels), budgeted income and budgeted cost, it is time to examine the importance of investment returns on spending policy. Ideally, the organisation can spend long term future investment returns less the rate of inflation, i.e. real total return. In practice, of course, the real world isn’t quite that amenable. Neither long term investment returns nor the rate of inflation are known with any certainty, while both can be volatile.

There are a number of common spending policies. One type of policy spends a proportion of income. This is rather outdated as it is meaningless to distinguish between income and capital gains. A likely result of using an income-based approach to spending is that asset allocation becomes subsidiary to spending policy. Higher income asset classes are, almost by definition, more attractive within this framework. Since asset allocation tends to dominate long-term returns, this is highly undesirable.

The most popular policy is the use of a percentage of historic average market value of the organisation’s investments. The time frame for averaging tends to be one to five years, and the average may be a simple average or an exponentially weighted average in which more importance is attached to most recent valuations. The averaging approach seems prudent because spending lags behind asset values that tend to rise over the long term. Spending is, thus, less likely to hit unsustainable levels.

Finally, some organisations set a simple policy of spending a predetermined amount each year. This works well if the predetermined amount approximates the average real return achieved by the organisation’s assets and has the advantage of predictable allocations for grants and donations, but in some ways is the most dangerous of the techniques in that the link between spending and assets is not explicit.

Blast from the Past

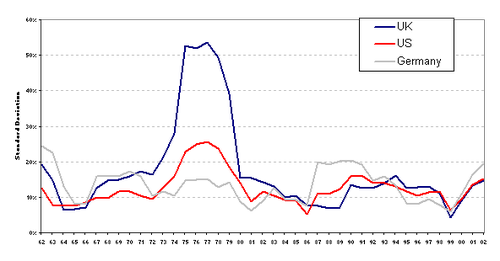

Real returns must be forecast in order to set spending policy. The future volatility of reserves also affects spending. For example, if volatility was zero and real returns were five per cent, year in and year out, then the spending target would clearly be five percent of market value per annum. Conversely, if assets were doubling and halving throughout the course of the year, then the spending target is less clear. It important to get a feel for expected volatility. Volatility since the late-1950s is shown in Figure 1.

Figure 1

5 Year rolling historic volatility for simulated UK, US and German funds invested 50% domestic equities, 20% global equities and 30% domestic government bonds from domestic currency perspective.

Looking at historic data, it would appear that planning for annual volatities in excess of 20% might be reasonable (or perhaps higher if one expected a re-run of the 1970s). We will return to this assumption later. Trustees would be well advised to sit back and consider for a few moments the worst case scenarios for their organisation’s reserve investments, given their current spending policy.

Risks of Averaging in a Falling Market

Averaging policies are perceived to be prudent because in a rising market capital gains are not immediately reflected in the organisation’s spending. Instead, by averaging the historic market value of the reserves, capital gains are only recognised gradually. Unfortunately, this approach has evolved during a long bull market and thus looks at only half the story. This policy is reckless in a bear market.

If we imagine negative returns over each year in, say, a seven year period (think Japanese equities), it is not to hard to work out how an averaging policy could be damaging to reserve values. As the market value falls, initially the level of spending continues to rise. This is fine in the case of a short downward blip; but how should a trustee distinguish between a blip and the start of a bear market? As markets continue to slide, spending growth slows, then turns negative, all the time lagging behind the fall in market value. Each year spending growth exceeds asset growth; the long term buying power of the fund is impaired. Should asset values spiral further downwards – at precisely the time when the organisation should be trying to avoid selling under-priced, attractive assets - the averaging policy may force inappropriate selling. If trustees believe in mean reversion of asset values, this is when they should bunker down and wait for a rebound.

Asymmetric Gain and Loss Recognition (AGLR)

It is worth considering how the prudent NGO might wish to manage spending during times of unusually strong or weak market performance. In periods of strong market performance, the NGO might use average historic market value in order to ensure that spending does not rise too fast. During a bear market, the NGO might suggest that falls in the market be reflected in spending somewhat more rapidly

Rather than spending the expected real return as a proportion of an average of market values, unexpected gains, due the market outperforming forecast real returns, and unexpected losses, due to the market under-performing forecast real returns, should be managed by way of a notional Gains and Losses Account. The rate at which the gains and losses are recognised and incorporated into the organisation’s spending policy can be different. By employing accelerated recognition of losses and delayed recognition of gains, organisational spending policy becomes more prudent irrespective of market direction.

This approach was tested by recognising gains over the course of four years and losses over only two years, both by analysing historic returns and examining simulated financial return distributions. Data from 1964 to the present day established how the UK organisation in Figure 1 employing AGLR would have fared relative to one using a simple four year rolling average of market value. Because of extreme asset volatility from 1973 to 1975, an organisation employing AGLR and a 5% payout target would have done much better than an organisation using an averaging methodology, with roughly a 15% greater final value by 1999 and with a slightly larger total spend over the period. In the bear period that followed from 2000 to 2002, the prudence encoded in AGLR reduced spending to levels more consistent with current means, thereby leaving the organisation in better shape to face the future.

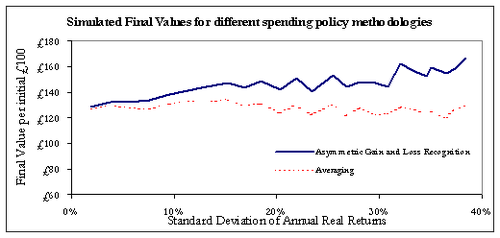

Simulation shows how AGLR offers considerable protection against the loss of a substantial amount of real purchasing power at higher levels of volatility. For example, over a 32 year period, a fund expecting real asset returns of 5% per annum and achieving 6% per annum with 20% volatility would have a final market value over 10% higher using AGLR as opposed to simple averaging, while paying out around 1%less in constant money terms (see Figure 2). Furthermore, AGLR copes relatively well when achieved asset returns lag behind expected real returns.

Figure 2

Simulated Final Values for different Spending Policy Methodologies. 32 year, period, assumed payout of 5%, achieved returns of 6% with varying levels of volatility.

Because the NGO can be more certain of the sense of its spending policy, the reserves attributable to “risk of default” can be reduced. In short, an NGO adhering to AGLR is capable, over the long run, of spending more and/or enhancing reserves while requiring less reserves for the “risk of default”. AGLR is a sensible methodology for risk/reward decisions on spending and retention. AGLR’s advantages enable NGOs to take more risk in order to achieve objectives, hopefully for greater reward.

Unfortunately, there is no free lunch; AGLR necessitates a sharper slowdown in spending in the face of falling asset values. However, during a prolonged fall in value, NGOs have to consider whether they can continue to base spending on historic and increasingly irrelevant market values. AGLR is an explicit spending methodology, yet is flexible enough to cope with changes in market conditions.

Managing Spending Volatility

Although AGLR increases spending volatility, there are many techniques available to NGOs for targeting expenditure. High priority projects could be separated from general spending and funded using a fixed income immunization or cash flow dedication strategy. Alternatively, spending could be segregated into tranches of decreasing priority. High priority projects or running costs could be funded from an allocation within spending that increases by a fixed proportion year on year irrespective of market conditions, while a more generalised pool of spending, perhaps focussed more towards capital spending or one-off grants, could be used to absorb the volatility.

Conclusion

NGOs should establish an explicit spending and reserves policy. This policy should include the NGO’s perceived risk of default, long-term assumptions on risk and return, investment return estimates, expenditure targets, how spending volatility will be managed and for many continuing organisations, in our view, some variant of AGLR. An explicit policy allows trustees to understand better the relationship between their investments, the behaviour of markets and their charitable objectives. Asymmetric Gain and Loss Recognition is a policy likely to preserve investments for the benefit of future generations while providing a prudent level of funding for the present.

References

[1] Michael Mainelli, Ian Harris and David Highton, “Save It For A Rainy Day: Setting Charity Reserve Levels”, NGO Finance, pages 62-65 (April 1996).

[2] Bill Bradley and Paul J Jansen, The McKinsey Quarterly, Volume 2 (web exclusive www.mckinseyquarterly.com) 2002.

Anthony Hene manages global equity portfolios at GMO for Not-for-Profit and other clients. Anthony has worked on GMO’s global equity investment process and research infrastructure and has published articles on the application of global style investing for institutional investors. He is currently working on the use of simulated markets to shed light on the problems of global investing.

GMO manages over £15bn of institutional funds in assets ranging from global equities to timber via emerging market fixed income with Not-for-Profit organisations representing approximately one third of the client base.

GMO, One Angel Court, Throgmorton St, London EC2R 7HJ, United Kingdom, tel: +44 (20) 7814-7600, www.gmo.com

Michael Mainelli is Z/Yen’s Chairman working across a variety of sectors (banking, insurance, media, utilities, television and distribution as well as Not-for-Profit organisations) on problems ranging from strategy through information systems, quality, human resources and performance improvement. Michael is a former Vice-Chairman of The Strategic Planning Society (a registered charity), a member of the Advisory Board for City University’s School of Informatics and a trustee of the Ocean Alliance/Whale Conservation Institute. Michael was a partner in a large international accountancy practice for seven years before a spell as a director of Europe’s largest R&D organisation and becoming a director of Z/Yen in 1995. He is co-author, together with Ian Harris, of their practical book "IT for the Not-for-Profit Sector” and their best-selling, humorous management novel "Clean Business Cuisine: Now and Z/Yen”.

Z/Yen Limited is a risk/reward management firm working to improve organisational performance through successful management of risks and enhancement of rewards. Z/Yen undertakes strategy, systems, people, intelligence and organisational change projects in a wide variety of voluntary sector organisations.

[A version of this article originally appeared as "Spend for Glory or Reserve Wastefully”, Charity Finance, Plaza Publishing Limited (February 2003) pages 28-30.]