Personalities of Risk/Reward: Human Factors Of Risk/Reward & Culture

By

Professor Michael Mainelli

Published by Journal of Financial Regulation and Compliance, Volume 12, Number 4, Henry Stewart Publications, pages 340-350.

Abstract: There is a gap linking organisational risk profiles to real people. Yet people are core to all risk/reward decisions, both at an organisational and a personal level. If an organisation is the aggregate of the decisions made by its people, how can we aggregate sensibly; how can we ensure concordance between the organisational risk/reward profile and its peoples’; what tools might help us? The paper concludes with suggestions for areas of potentially fruitful research into how personal risk/reward profiles can be assessed and analysed to inform organisational risk/reward decisions.

Neither Top Nor Bottom Be

The objective of this paper is to be a bit James Bond - to leave you slightly shaken and optimistically stirred. Shaken from analytical complacency. Stirred by the chances to grasp new ways of managing risk based on the realities of human nature. The key theme is that people are intrinsic to all risk/reward issues. Z/Yen’s work tries to build organizational systems that take account of people and culture within a structured risk/reward framework. However, our work diagnosing and prescribing risk/reward in organizations frequently leaves many of us feeling like mediaeval doctors – we can help with a bit of luck, but we lack grounding in the basic science of the work, bacteriology, virology, genetics, scanners or even proteomics. This is hardly surprising. There has been little work relating individual risk/reward profiles to an organizational risk/reward profile, but the relationship between individuals and organizational risk/reward profiles creates fantastic research opportunities.

When Management-by-Objectives was popular, the paradigm implied a top-down tree of objectives. Moving from the bottom to the top, in theory one could sum the objectives of the individuals working in the organisation to ascertain and assess the overall organisational objectives. A richer view has emerged. The organization has an overall risk/reward profile. This profile can be shared, i.e. marketing is biased towards more reward than risk, while finance is biased more towards risk avoidance than rewards. Again, in theory one could sum the risk/reward profiles of the individuals working in the organization to ascertain and assess the overall organizational risk/reward profile. But we seem to lack the tools to do so.

It’s All About Numbers

Risk/Reward management defines three types of activity that improve organisational performance - risk avoidance, reward enhancement and volatility reduction [Harris, Mainelli & O’Callaghan, 2002]. Risk avoidance activities reduce large exposures, e.g. continuity planning, insurance or legal compliance activities. Reward enhancement activities are normal management projects to increase performance such as training, cost reduction or production improvement. Volatility reduction is subtle, yet activities that reduce volatility or improve consistent delivery add measurable value.

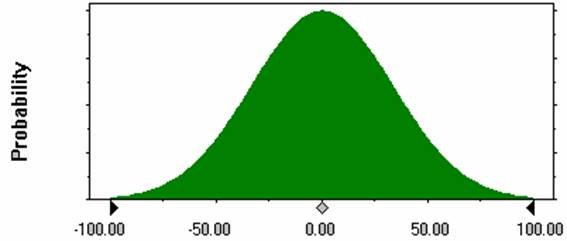

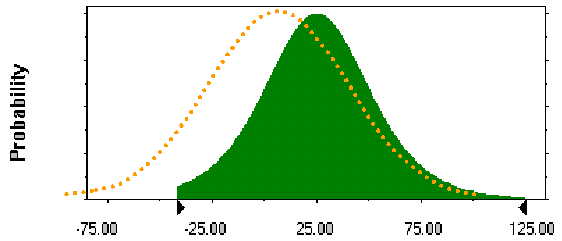

Risk/Reward management can be summarised in four diagrams and three objectives. Imagine an organisation looking at reducing cost. Expected outcomes [Diagram 1] might range from ‘on budget’ (0.00) to a lot more cost (-100.00) or a lot less cost (+100.00).

Diagram 1: Expected Outcomes

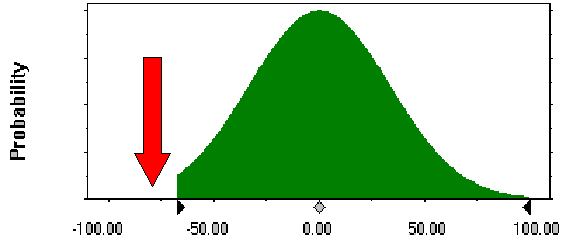

The first objective is [Diagram 2] risk avoidance: managers look to ensure that they can, through better skills, insurance or knowledge, eliminate particularly adverse outcomes.

Diagram 2: Risk Avoidance

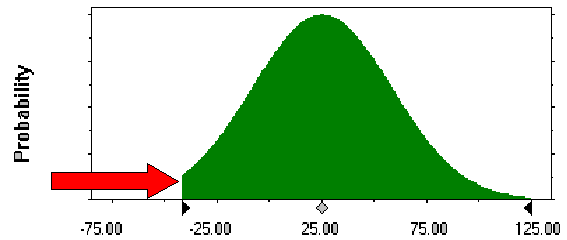

The organisation can also look to [Diagram 3] an objective of reward enhancement. Managers will often promote reward enhancement in terms such as increased productivity, improved staff workplace satisfaction or better contracting. A whole range of typical management decisions such as cost reduction, sales, marketing, logistics improvement or training may lead to improved outcomes. The outcomes ‘shift’ positively to the right.

Diagram 3: Reward Enhancement

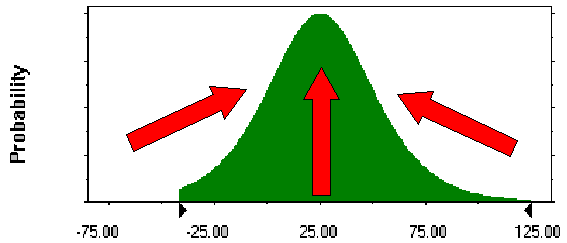

Finally, and more subtly, the organisation can [Diagram 4] look to an objective of reducing volatility, by delivering consistently on costs and sales and thus ‘tightening’ the range of possibilities.

Diagram 4: Volatility Reduction

In this example, all three objectives, risk avoidance, reward enhancement and volatility reduction combine to move from a starting range of –100.00 to +100.00 with a mean of 0.00 to a range of –30.00 to +125.00 with a mean of 25.00, and a much higher likelihood of hitting that mean [Diagram 5].

Diagram 5: Combined Shift in Outcomes

We are rapidly moving to exciting new ways of handling risk at the technical end. Z/Yen has coined an expression to highlight certain emerging IT applications – Dynamic Anomaly and Pattern Response - Dynamic (adaptive and learning from new data in real-time) Anomaly (identify unusual behaviours) and Pattern (reinforce successful behaviours) Response (initiate a real-time action). Recent advances in statistics, such as statistical learning theory, are being successfully applied in a number of markets from manufacturing through logistics to finance where IT systems need to be applied in dynamic environments and the rules cannot be precisely specified in advance because they change. Using these real-time actuaries, we are starting to guess what people will do before they do it – including making mistakes, making claims or defrauding others. Truly mature customers of scale, e.g. manufacturing multi-nationals, have transformed their purchases of insurance into enterprise risk/reward management systems [2 - Mainelli, 2003]. Mature customers build internal markets and risk transfer structures, leaving the insurance industry with reinsurances at best. We are automating risk/reward decisions where possible, but people, again, are intrinsic to the bulk of the organisation.

It’s All About People

People aren’t the problem – they are the most important component of the system. Virtually all operational risks are people risks, ranging from fraud to miscommunication, poor incentives, poor decisions through to outright mistakes. An increasingly popular research area these days is Behavioral Economics, trying to analyse systematic biases in human decisions. Congitive barriers that impede rational decisions have been recognised since at least the time of Bacon – individual peculiaralities, limits of language, pre-existing beliefs and inherited foibles of human thought – Bacon’s “idols” [Schermer 2004]. Economists, and other social scientists with an interest in decision-making, have found that the difference between the rational model (how decisions ought to be made) and the real world (what decisions are made) is so significant that their rational models can be of little use. Increasingly, economists are trying to take into account empirical work on decision-making in the real world. Seminal work was done by Daniel Kahneman and the late Amos Tversky starting in the 1960’s by looking at the relationships between psychology and economics. Kahneman was awarded the 2002 Nobel Prize in economic sciences “for having integrated insights from psychological research into economic science, especially concerning human judgment and decision-making under uncertainty.” Tversky and Kahneman developed Prospect Theory around the concept of “framing” to explain why people would, on average, prefer risk when they feel ‘behind’ and prefer safety when they feel ‘ahead’.

Prospect Theory emphasises the importance of framing the problem. The way in which a problem is presented, i.e. as starting from a position of gain or from a position of loss, is crucial to the position of the neutral reference point. The difference between Prospect Theory and economic theories of diminishing marginal utility is that marginal utility assumes that people only consider their choices in terms of the final outcome, not from where they start. At first glance, framing seems either hard or non-sensical, however framing is everything.

There are other systematic, partially predictable, biases in human decision-making. To enumerate a few, overconfidence in our own abilities, over-optimism about the future, relying overly much on our own experiences, anchoring decisions around suggested solutions, sunk-cost effects, herd instincts, counterproductive regret and spending too much time on small decisions rather than larger ones. How people behave creates risks [Howitt, Mainelli & Taylor, 2004]. Some basic examples include tribalism & the herd mentality; “keeping face” & trust; turf & ownership; greed & fear; the corruption of power. Behavioral Economics is fascinating and some of its theoretical frameworks are being applied both to identify opportunities, e.g. undervalued equities, or to improve decision-making, e.g. imposing procedures that attempt to correct for known biases and bring decisions more into line with “rational” behaviour, i.e. what a risk-neutral entity would choose.

A related, more fundamental, research area is Evolutionary Psychology. Evolutionary Psychology notes that the human brain consists of a collection of functionally specialised computational devices that evolved to solve the adaptive problems regularly encountered by primates. As humans share an evolved architecture, individuals are likely to develop a distinctively human set of preferences, motives, shared conceptual frameworks and reasoning procedures with many characteristics in common. It is anticipated that over time stronger links will arise among many sections of this paper, including Systematic Behavioral Biases, underpinned by theories from Evolutionary Psychology, that will help explain why human decisions are rarely risk/reward-neutral or rational.

It’s All About Dynamic Organisational Systems

In the life insurance markets there is a malevolent public debate about the acceptable or ethical limits of using new information techniques to price risk. The key new technique is DNA testing. With DNA testing, it is asserted, insurers can price risk even more keenly. Consumers are objecting to the potential for keen pricing, stressing things such as the social basis for permitting insurance companies existence or the invasion of privacy. If DNA testing were more acceptable, insurers would almost certainly seize it. The strange thing is that similar techniques are already available in commercial lines, yet insurers are not seizing them. The corporate DNA testing equivalent is advanced statistical analysis. The corporate genome contains indicators of the risks most likely to affect the business – but people are involved.

Systems are all well and good, however we seem to ignore ancient (albeit slightly sexist) advice that the proper study of man is man himself. So we need ways of measuring, analysing, categorising and calculating the aggregations of people’s views – a language for risk that involves peoples’ viewpoints. There are few, if any, authoritative tools to aggregate the views of thousands of people in an organisation and see how the people fit the organisational risk/reward profile. For instance, one might suggest psychometric testing of individuals and assume that the aggregate or averaged profile is the profile of the organisation. However, this approach assumes much – that the psychometric tests are valid, that they have been calibrated for culture (e.g. we’re not using mid-Western USA college student responses to evaluate our global petrochemical managers), that the underlying questions ‘test’ the risk/reward space (a stretching assumption when faced with “which would you prefer” or word affinity questions), or moreover that the questions are summable or averageable. Is one Belbin “monitor-evaluator” worth two “resource-investigators” in an investment bank; in a government organisation? We face a paradox, particularly as financial, systems or analytical people – you can’t make rational decisions without planning around people – yet that requires placing an unprovable value on non-financial inputs and outcomes.

The Tools Might Exist

A variety of business thinkers promote “leadership” as a way of cutting through the complex trade-offs. If people “follow the leader’s example”, then they will make appropriate decisions for the organisation. However, the leader can’t be everywhere. Not all decisions are suited to simple solutions. Some leadership styles may work with the front-facing parts of the organisation, e.g. projects or sales, but not with others, e.g. finance or logistics. Sometimes there aren’t leaders. Another set of business thinkers promotes “culture” as way of calculating trade-offs. Culture is “the way we do things around here.” Perhaps culture could be more accurately defined as “the way we decide to do things around here”. However, this means changing the culture by grabbing, changing and enforcing decisions at all levels – recruitment, procurement, investment or marketing decisions. In fact, many of the mechanisms for achieving corporate change [Mainelli, 1992], i.e. turning vision into action, are not amenable to aggregate analysis.

Financial decision theory has attempted to put finance forward, with some success, as a meta-decision framework for organizations, encompassing alternative financing and debt/equity trade-offs (Capital Asset Pricing Model), shareholder value added (hurdle rates, risk-adjusted return on capital), time cost of money (Net Present Value) and volatility (risk/reward options). Finance provides a single “currency” for corporate decisions. Can this financial model be reconciled with social responsibility decisions? Some progress has been made, particularly about incorporating volatility reduction of outcomes as a positive result of investment, but it is difficult to see in the near-term how psychological risk/reward profiles can be quantified in financial terms. In the long-term, this may be a desirable goal.

Others have attempted to integrate organisations through the use of stories, or scenarios, trying to turn a bunch of numbers folk into the firm of Grimm, Grimm & Grimm or Hans Christian (Arthur) Andersen. Scenarios are stories with a boring cost/benefit equation attached, i.e. getting everyone to think together ‘ought’ to pay off, particularly in crises, but one of the biggest problems is developing stories which have the right spread of events to help the business. In other words, how can one ‘map’ the universe of useful risk scenarios for people, not just make up tales? Further, how can one start to guess which story will most help which type of individual?

Risk/Reward Personalities

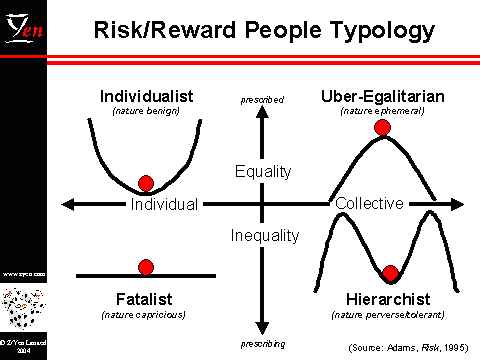

Adams [Adams, 1995], Hollings and others, such as Geert Hofstede, working on culture, have begun classifying people’s views of risk as ways of classifying their views and their cultures. Adams’ [Diagram 6] first axis, the horizontal, divides people into those who look at collective risk versus those who look to themselves. His second axis, the vertical, looks at those who see the world as one at the top where authority sets the rules, equally applied even if unfair, and the bottom where people make the rules themselves. Adam’s and others’ work has been adapted slightly by Z/Yen such that the four resulting risk character types each view a different world.

Diagram 6: Risk/Reward Personalities

Each character type has a ‘ball’ on a slope, that, if destabilised, might destroy their world. Before getting deep into libel and slander, it should be emphasised that people exhibit different risk profiles at different times and in different situations. Profiles are merely tools to help us make a small amount of sense of a confused world. Organisations too have different risk profiles within different functions, e.g. accounts versus fundraising, etc. Taking each quadrant in turn:

Fatalist - Unsettled Times

The Fatalist sees nature as capricious. Nothing they do changes the way the ball moves. At best, it’ll all come back and bite ’em. At first glance, these folk are the least interesting, after all they just sit there and take it. Strangely, after you do this a few times, this position gets more and more interesting – it’s how most of us react to the vast majority of decisions we face every day, including things like not turning out to vote for the London mayor or not contesting an invalid parking ticket or not changing our mortgage ’cause they’re all the same in the end. At first glance, the Fatalist is uninteresting, but over time it seems to be the quadrant of the majority. Moving people out of the Fatalist camp is the quickest way to gain political support for change as the other three quadrants are very hard to shift.

Individualist - Free for All

The Individualist is almost a parody of an 80’s yuppie. It would take a complete catastrophe to disturb their little ball. Nature is benign – it won’t hurt him or her. If they hit you with their late-model car, well, let them know how much they owe – see you later. At the extreme, we could put quite a few fund-raisers into this category – for the right deal a bit of tobacco sponsorship may be a good thing, after all the money was going to go somewhere.

Über-egalitarian – Control Freaks

The Über-egalitarian is almost a parody of a 60’s or 70’s socially-conscious individual – Earth Day, the Good Life, sandals. The ball is barely being held stable. Nature is ephemeral, about to be overwhelmed at any minute, thirty years ago it was the coming Ice Age, today it’s global warming. The über-egalitarian mode could be assumed to be the working mode of most activists. Their battle cry is often “there ought to be a law…”.

Hierarchist - Power Brokers

The Hierarchist sees nature as something to be overcome, but manageable. The little ball is stable within ‘normal conditions’, but extremes are to be avoided. The hierarchist is a natural bureaucrat and loves decisions based on sound thinking, however irrational the result. He or she is most likely to be the only one of the four character types who would value cost/benefit analysis. Some would say that most finance directors are in this mode during their working life. They are in conflict over rules with the Über-egalitarians, but agreed that the Individualists (marketing) need to be contained.

Risk/Reward Profiles

All risk profile stereotyping is a crude tool. Individuals inhabit different positions at different times in different circumstances for different decisions. One may be a fatalist about comet disasters - **it happens; an individualist about one’s children’s education – why can’t I have school vouchers? a hierarchist about corporate rules – we need to enforce our expenses policy; and an über-egalitarian about corporate pollution – it’s a crime; it shouldn’t happen.

One can map these risk profiles back to help fit people into risk/reward systems. Depending on your view of the world, you are more likely to deploy a different risk profile based on high or low risk and reward environments. You need to hear a story that suits you. Some people find it easier to remember AA Milne’s Winnie-the-Pooh risk profiling. Pooh is the individualist who sees it all coming right in the end – there’s always a hunnypot. Tigger is ‘off the scale’ of individualism. Owl is the hierarchist who wants to understand the order in the world and make sure that others follow it. Eeyore is obviously the fatalist and Piglet probably the über-egalitarian. One can create separate, convincing, consistent stories for each stereotype, in order to promote change.

A small example of this categorisation in financial regulation and compliance might be people’s (actual clients) views on know-your-client questionnaires designed to assess their risk/reward investment appetites. Despite perhaps being very high-net worth individuals or low income close to retirement people, they may occupy any of the four personalities:

- Fatalist: most people; nothing matters; these questionnaires are non-sensical and achieve little;

- Individualists: what matters is my choice of where the investments go;

- Über-Egalitarian: for me, who bears the risk if this all goes wrong? for society, how can we use our investments to achieve social, environmental or ethical ends?

- Hierarchist: let’s fill this questionnaire in perfectly in order to obtain best advice (strange that the questionnaire seems rather simplistic).

As a simple application, each group needs a different story about the risk/reward discovery surrounding clients. To Fatalists – it’s the law to get you to fill out these questionnaires; nothing you can do will change this. To Individualists – this specification will help us follow your desires. To Über-egalitarians – in such dangerous world, we need you to understand the risks you face. To Hierarchists – completing these questionnaires is going to help us to help you. It is interesting to speculate where the non-savers or the non-investors might fit. What is important is recognising that to change people’s behaviours we need to change their cognitive filters or work with their cognitive filters to get them to behave in a way we desire.

The Tools Need Research

We are struggling to resolve fundamental gaps in our understanding of how to probe risk/reward propensity. Firstly, what risk/reward trade-offs do people expect in certain situations – new product launch, fraud reduction, personal pension, salary, financial returns on investments, budgetary variance, etc. Secondly, even if we had their risk/reward trade-offs, we are unable to sum individual risk/reward profiles into an overall organisational risk/reward profile.

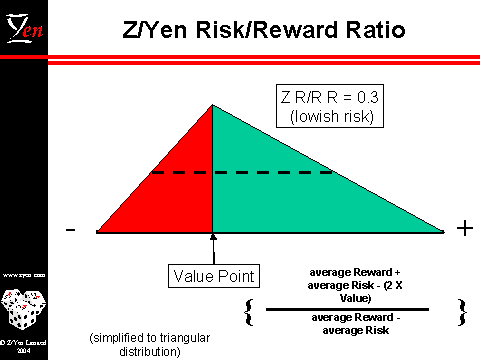

Perhaps people can best absorb information about future decisions if it were structured in standardised diagrams using value information incorporated in triangular distributions such as Z/Yen’s risk/reward ratio [Diagram 7]:

Diagram 7: Z/Yen Risk/Reward Ratio

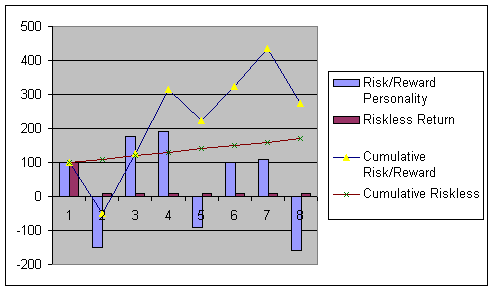

Perhaps people could best be sampled on their risk/reward profile for certain types of decisions by looking at the trade-off between a base level of known return (e.g. government bonds) and their desired return [Diagram 8]. These diagrams could allow them to sample a number of decisions, e.g. a new investment, meeting investment targets, meeting budget targets, headcount growth, profit/person growth, etc. From diagrams such as these, one can ‘freeze’ attitudes at a point in time. If the decision in Diagram 8 was a desired rate of return over eight years, rather than vague ‘risk-seeking’ or ‘risk-averse’ categories, one could determine specific numbers, i.e. maximum loss, implicit rate of return, implicit rate of return above riskless rate, requisite minimum annual income levels, implicit level of re-investment.

Diagram 8: A Template Sampler for Risk/Reward by Decision

Perhaps these diagrams could be ‘additive’ across the people in an organisation. There would be some interesting weightings; are all people equal? should these diagrams be weighted by seniority, by income, by salary, by position, by people managed, etc.?

Framework for Research

A core belief is that organisations improve if the people in the organisation can make better decisions. Ideally, better information, better decision-making tools and better decision-implementation tools ought to improve an organisation faster than its peers. Future research needs to combine three things:

- people and culture risk/reward sampling;

- systems theory showing how many individual samples can aggregate to an organisational view;

- markets – resources and prices – how organisational decision-making structures can use information to affect individual decisions in order to support the overall corporate risk/reward profile.

It is difficult to determine what might be the outcome of any particular research project looking at ‘sensing’ individual risk/reward profiles in such a way that they can provide an organisational risk/reward profile. However a few pointers are in order:

- the importance of individual perception in assessing risk/reward is crucial, rather than what appear to be ‘facts’, i.e. it is my perception of future earnings and judgement of the future that matter, not necessarily my historic salaries and salary today;

- categorisation that typically results from fact-finding, e.g. “risk averse” or “risk taking” decision-taker is, at best, flawed, but possibly dangerous. A decision needs to be evaluated on what effect is has on an investor’s portfolio. A decision may be risky to one investor with a particular portfolio, neutral to another and provide beneficial diversification to a third. Portfolios change over time. However, it is likely that certain decisions are unlikely to form part of, say, an inherently “risk averse” decision-maker’s portfolio;

- genuine risk/return explanations for decisions require an understanding by the decision-maker of distributions of potential returns to his or her total portfolio. The effect of any analytical decision on a portfolio probably requires access to some form of Monte Carlo tool that can draw a picture of the combined distributions of the portfolio and the decision.

- it does seem that little research has been done on effective ways of conveying risk information to decision-makers. A basic psychometric test of different presentational methods, e.g. number, text, types of diagrams, would be worthwhile.

Pointers for Further Research

No one seems to know how decision-makers best absorb and use risk/reward information. In fact, our understanding of how they use technology in risk/reward is also at an early stage [7 – Mainelli, 2003]. There are a number of obvious possibilities (and multiple variants):

- decision-makers have no common risk/reward “vocabulary” and can’t understand the concept coherently;

- decision-makers best absorb risk/reward information as risk/reward numbers directly;

- decision-makers have normative ideas for concepts such as “low risk”, “high risk”, “very high risk”;

- decision-makers need to deal with concrete examples, or worked examples, and these help them immensely;

- decision-makers can apply labels to their own circumstances (leading to further work on which ones);

- decision-makers can handle distribution functions, if standardised;

- a proposed Z/Yen structure of a Java-applet incorporating bar charts and returns [a dynamic Diagram 9] could capture the “know your client” risk/reward propensity and “lock” it at that time. Where the ‘client’ is an employee in an organisation, this could be aggregated.

The key research question is “can we develop a means of sampling individuals’ risk/reward profiles on certain questions and use that sample to infer concordance with organisational risk/reward profiles?” These are early stages for understanding how individual risk/reward propensities, ‘personalities’ if you will, affect organisational ‘personalities’. However, as people are the biggest risk, financial regulation and compliance needs to develop further theories and further tests in order to turn from a rule-based culture of imposition to a culture that helps organisations establish flexible, dynamic risk/reward systems within a more rigorous theoretical framework.

[An edited version of this article first appeared as "Personalities of Risk/Reward: Human Factors of Risk/Reward and Culture", Journal of Financial Regulation and Compliance, Volume 12, Number 4, Henry Stewart Publications (November 2004) pages 340-350.]

References

- Ian Harris, Michael Mainelli and Mary O’Callaghan, “Evidence of Worth in Not-for-Profit Sector Organisations”, Journal of Strategic Change, Volume 11, Number 8, pages 399-410, John Wiley & Sons (December 2002).

- Michael Mainelli, “The Consequences of Choice” (enterprise risk/reward management systems), European Business Forum, Issue 13, pages 23-26, Community of European Management Schools and PricewaterhouseCoopers (Spring 2003).

- Michael Schermer, “The Enchanted Glass”, Scientific American, page 27, May 2004.

- Jonathan Howitt, Michael Mainelli and Charles Taylor, “Marionettes, or Masters of the Universe? The Human Factor in Operational Risk”, Operational Risk (A Special Edition of The RMA Journal), pages 52-57, The Risk Management Association (May 2004).

- John Adams, Risk, UCL Press Limited, 1995.

- Michael Mainelli, “Vision into Action: A Study of Corporate Culture”, Journal of Strategic Change, Volume 1, Number 4, pages 189-201, John Wiley & Sons (July-August 1992).

- Michael Mainelli, “Risk/Reward in Virtual Financial Communities”, Information Services & Use, Volume 23, Number 1, pages 9-17, IOS Press (2003).

Michael Mainelli, PhD FCCA FCMC MBCS MIS, originally did aerospace and computing research followed by seven years as a partner in a large international accountancy practice before a spell as Corporate Development Director of Europe’s largest R&D organisation, the UK’s Defence Evaluation and Research Agency, and becoming a director of Z/Yen (Michael_Mainelli@zyen.com).

Michael’s humorous risk/reward management novel, “Clean Business Cuisine: Now and Z/Yen”, written with Ian Harris, was published in 2000; it was a Sunday Times Book of the Week; Accountancy Age described it as “surprisingly funny considering it is written by a couple of accountants”.

Z/Yen Limited is a risk/reward management firm helping organisations make better choices. Z/Yen undertakes strategy, finance, systems, marketing and intelligence projects in a wide variety of fields (www.zyen.com), such as developing DTI Smart award-winning DAPR software, developing new risk transfer services or benchmarking transaction costs across global investment banks.

Z/Yen Limited, 5-7 St Helen’s Place, London EC3A 6AU, United Kingdom; tel: +44 (0)20-7562-9562.