Market Of Markets: The Global Financial Centres Index

By

Professor Michael Mainelli

Published by Journal of Risk Finance, The Michael Mainelli Column, Volume 8, Number 3, Emerald Group Publishing Limited (May 2007), pages 313-319.

Professor Michael Mainelli, Executive Director, The Z/Yen Group

[An edited version of this article first appeared as "Market of Markets: The Global Financial Centres Index", Journal of Risk Finance, The Michael Mainelli Column, Volume 8, Number 3, Emerald Group Publishing Limited (May 2007) pages 313-319.]

Frank Sinatra Or The Clash?

Is “New York, New York” the leading global financial centre, or is “London Calling”? The Global Financial Centres Index (GFCI) evaluates the competitiveness of 46 financial centres worldwide. The GFCI, commissioned by the City of London Corporation and researched by the Z/Yen Group, rates London at 765 points on a scale from 1 to 1,000, and New York at 760, just five points apart. The third highest-rated city is Hong Kong at 684, 76 points lower. The GFCI top 20 are:

| Financial Centre | Rank | Rating |

|---|---|---|

| London | 1 | 765 |

| New York | 2 | 760 |

| Hong Kong | 3 | 684 |

| Singapore | 4 | 660 |

| Zurich | 5 | 656 |

| Frankfurt | 6 | 647 |

| Sydney | 7 | 639 |

| Chicago | 8 | 636 |

| Tokyo | 9 | 632 |

| Geneva | 10 | 628 |

| Paris | 11 | 625 |

| Toronto | 12 | 611 |

| San Francisco | 13 | 611 |

| Boston | 14 | 609 |

| Edinburgh | 15 | 605 |

| Cayman Islands | 16 | 604 |

| Hamilton (Bermuda) | 17 | 603 |

| Melbourne | 18 | 603 |

| Channel Islands | 19 | 600 |

| Washington D.C. | 20 | 594 |

It must be gratifying for economists to see the cause of potential relocation attributed so directly to regulation:

London’s Mayor Ken Livingstone recently visited New York, trolling for businesses that might relocate jobs and investment activity from the United States to Great Britain. Asked what he considered London’s competitive advantage over New York, he replied, "Sarbanes-Oxley.

New York View:

The city's [New York’s] Economic Development Corporation said yesterday it is hiring McKinsey and Company for $600,000 to formulate a strategy for New York to maintain its title as financial capital of the world … London has gained ground on Wall Street in recent years, experts say, with expanding European markets, an explosion of activity in the hedge fund business and an increasing number of companies that are choosing to go public on the London Stock Exchange, as opposed to in New York. Some say that London is benefiting from America's Sarbanes-Oxley Act of 2002, sweeping legislation that created new corporate governance, financial disclosure, and public accounting standards for companies. Critics said the legislation increased the cost of doing business here.

London View:

London is overtaking New York and is re-establishing itself as the world’s financial centre for the first time since the days of Empire.

What Makes A Centre Competitive?

There are five key areas of financial centre competitiveness:

- ‘People’ - the availability of good personnel and the flexibility of the labour markets;

- ‘Business Environment’ – regulation, tax rates, levels of corruption and ease of doing business. Regulation is currently cited as the decisive factor in the relative competitiveness of London and New York;

- ‘Market Access’ - levels of trading, as well as clustering effects from having many financial services firms together in one centre;

- ‘Infrastructure’ - the cost and availability of property and transport links;

- ‘General Competitiveness’ - the concept that the whole is ‘greater than the sum of the parts’.

The GFCI shows that you need to be good at most things to be a leading centre. London and New York are in top quartile of over 80% of the nearly 50 instrumental factors used to build the GFCI. Being a truly international city helps – 40% of Londoners are foreign born and over 300 languages are spoken. The capital’s two strongest football teams now often field teams with no English players at all. London and New York are both places where the best international firms congregate and trade with each other. London appears to be particularly strong on regulation and the quality of its people. The main negative comments are corporate tax rates, transport infrastructure and operational costs. New York is also very strong in most areas - people and market access are particular strengths. Regulation, particularly Sarbanes-Oxley, is the main negative factor for New York.

Hong Kong is a thriving international centre, performing well in all of the key competitiveness areas, especially regulation. Singapore is close behind, with banking regulation, again, seen as being excellent. Zurich is a very strong niche centre - private banking and asset management provide a focus. Zurich performs well in many areas of competitiveness but loses out slightly in people factors.

Financial Centre Roles

Successful financial centres fulfil one or more roles:

- ‘Global’ financial centres that are truly global foci, where only two can claim that role, London and New York;

- ‘International’ financial centres such as Hong Kong that conduct a significant volume of cross-border transactions;

- ‘Niche’ financial centres that are worldwide leaders in one sector, such as Hamilton in reinsurance;

- ‘National’ financial centres that act as the main centre for financial services within one country, such as Toronto (12th) in relation to Montreal (21st) and Vancouver (27th);

- ‘Regional’ financial centres that conduct a large proportion of regional business within one country, e.g. Chicago.

‘International’ activity involves at least two locations in different jurisdictions. Global deals often increase the number of involved parties markedly, e.g. adding lawyers and analysts to a mix of syndicated finance. A direct foreign exchange deal between a retail bank in Korea and a Tokyo investment bank is international, the addition of a third party, e.g. backing with a credit derivative, is likely to make the deal global. Global financial centres come into their own when there is a need for more than two parties or for deep liquidity.

Several centres score highly in the GFCI on the basis of being strong in one particular niche of financial services, e.g. Zurich for private banking. While these ‘niche’ financial centres will never rival London or New York as global financial centres, they are as strong as London or New York within their own sectors. Centres play multiple roles, e.g.:

| Centre | Global | International | Niche | National | Regional |

|---|---|---|---|---|---|

| London | X | X | X | X | X |

| Hong Kong | X | X | |||

| Chicago | X | X | X | ||

| Hamilton | X | X | |||

| Sydney | X | X | X |

Who Will Upset The Apple Cart?

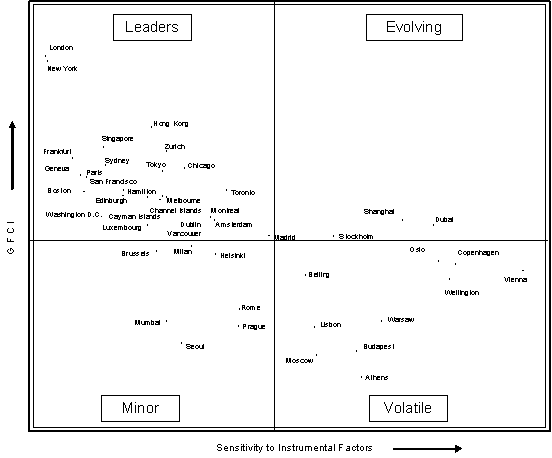

If a city’s ranking changes markedly when re-ranking the centres without one area of competitiveness (e.g. ‘People’), it indicates that this city has more sensitivity to the factors and will thus have more volatile rankings in the future:

This categorisation identifies four types of global financial city:

- leaders: obviously London and New York, but also centres with strong sub-sectors and strong domestic markets;

- minor: cities that are not rated as highly, and are highly unlikely to improve in the near term. It is interesting to note that Rome, Mumbai and Seoul fall into this category. Each of these has large domestic markets, but seem unlikely to change their poor ratings soon;

- volatile: cities that are not rated as highly, but might be able to move upwards rapidly if they could fix some factors. Interestingly, Athens has gained from improvements in infrastructure due to the 2004 Olympic development, but needs similar improvements in the other four groups of factors;

- evolving: cities with high ratings, but susceptible to change. It is interesting to see that Dubai and Shanghai are already matching some established centres in certain factors. Dubai has clearly focused on attracting regional business, while Shanghai has been the focal point for its domestic business.

Very few people believe that London or New York will lose their positions as global financial centres within the next ten years. Research in 2005 showed that people factors were most important. Now the biggest threats, and opportunities, for London and New York come from changes in the regulatory environment. Sarbanes–Oxley has adversely affected New York and tax levels in the UK raise concerns.

Apples for Big Fish?

The Santa Fe Institute has found evidence of increasing returns to scale in city inventiveness and creativity. These increasing, and accelerating, returns emerge from the fact that the value of connections rises with the number of participants in the network. Each participant connecting to the network improves their productivity markedly, while also contributing to the productivity of those already connected. A thought experiment affirms the idea of network benefits – if there were two world wide webs, wouldn’t they be even more powerful if they were connected into one? And network dangers - might they also be more vulnerable?

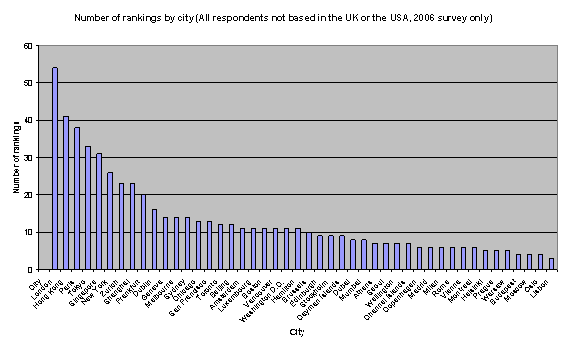

One area for future research and work on instrumental factors is the ability of a global financial city to harness effectively the work of other specialist financial centres. London seems to do this well, witness the strong links with Dublin, Hamilton, Switzerland and the Channel Islands. Presumably, a more mixed model of a global financial city is that it leverages on the strengths of its connections – culture, immigration, taxation, air transport, telecommunications – with other financial centres. The following diagram illustrates the strength of connections. When looking at people who ranked three cities or more, not based in the UK or the USA, it becomes obvious that London and Hong Kong are the ‘foreign’ cities non-residents know best and are prepared to rank. New York drops to 6th in this regard, indicating that for a significant number of non-residents it is not their ‘connected’ global city. There may be a number of reasons ranging from visa issuance, to telecommunications or old school ties, but New York just isn’t as connected with non-nationals.

As with any home team bias, cities need to play to their strengths. This suggests at least two ways for smaller cities to compete. First, make sure that the inducements to set up new businesses are high, e.g. Dubai. After you have the people, the home team bias might help them stay. This approach is an old one, witness the large number of development agencies, overseas representative offices and other inducements to help people and organisations make the first big step, any presence at all. To this mix should clearly be added regulatory competitiveness. Secondly, promote your focal sector with zeal. Rather than stretching credulity by claiming to be a global financial centre across the board, be very specifically honest. Define your competitive sphere so narrowly that you are guaranteed to be ‘first in your class’. Then proclaim loudly that you are the pre-eminent centre for that small global financial sector. If you can’t be a Big Apple, being a “big fish in a small pond” will do nicely.

Thanks

My very special thanks to Mark Yeandle of the Z/Yen Group for his very significant help with this article, and to the City of London Corporation, especially Malcolm Cooper, Shaun Curtis and Gail Armstrong, for all their support and advice during our research. All of our thanks are given to those financial services professionals who provided GFCI rankings.

References

- Michael Mainelli and Mark Yeandle, The Global Financial Centres Index - 1, 64 pages, City of London Corporation (March 2007).

- Michael Mainelli, "Global Financial Centers: One, Two, Three ... Infinity?", Journal of Risk Finance, The Michael Mainelli Column, Volume 7, Number 2, pages 219-227, Emerald Group Publishing Limited (March 2006).

- Mark Yeandle, Michael Mainelli and Adrian Berendt, The Competitive Position of London as a Global Financial Centre, Corporation of London, 67 pages, (November 2005).

Professor Michael Mainelli, PhD FCCA FSI, originally undertook aerospace and computing research, followed by seven years as a partner in a large international accountancy practice before a spell as Corporate Development Director of Europe’s largest R&D organisation, the UK’s Defence Evaluation and Research Agency, and becoming a director of Z/Yen (Michael_Mainelli@zyen.com). Michael is Mercers’ School Memorial Professor of Commerce at Gresham College (www.gresham.ac.uk).

Z/Yen is a risk/reward management firm helping organisations make better choices. Z/Yen operates as a think-tank that implements strategy, finance, systems, marketing and intelligence projects in a wide variety of fields (http://www.zyen.com), such as developing an award-winning risk/reward prediction engine, helping a global charity win a good governance award or benchmarking transaction costs across global investment banks. Z/Yen’s humorous risk/reward management novel, “Clean Business Cuisine: Now and Z/Yen”, was published in 2000; it was a Sunday Times Book of the Week; Accountancy Age described it as “surprisingly funny considering it is written by a couple of accountants”.

Z/Yen Group Limited, 5-7 St Helen’s Place, London EC3A 6AU, United Kingdom; tel: +44 (0) 207-562-9562.