How Do The Swiss Financial Centres Compare With The Rest Of The World

By

Professor Michael Mainelli and Chiara von Gunten

Published by Swiss Banking Year Book 2013 (April 2013), pages 25-37.

Michael Mainelli and Chiara von Gunten, Z/Yen Group Limited

[An edited version of this article appeared as "How do Swiss Financial Centres Compare to the Rest of the World", Swiss Banking Yearbook 2013, Banque & Finance, (April 2013), pages 25-37]

For the French version, please click here.

Every six months since 2007, the Global Financial Centres Index (GFCI) published by Z/Yen Group provides profiles, ratings and rankings for 77 financial centres, drawing on two separate sources of data: instrumental factors (external indices) and responses to an online survey.

Many factors combine to make a financial centre competitive. The GFCI draws on over 86 instrumental factors which are grouped into five areas of competitiveness: People, Business Environment, Infrastructure, Market Access and General Competitiveness. In addition, GFCI uses responses to an ongoing online questionnaire completed by international financial services professionals. Respondents are asked to rate those centres with which they are familiar and to answer a number of questions relating to their perceptions of competitiveness. Overall, 28,180 financial centre assessments from 1,890 financials services professionals were used to compute the last edition of the GFCI, with older assessments discounted according to age. Overall ratings combine scores based on both instrumental factors and assessments by GFCI respondents around the world.

Zurich and Geneva in the Top 10 world centres

London, New York, Hong Kong and Singapore have consistently been in the top four of the Global Financial Centres Index. We continue to believe that the relationship between London, New York and Hong Kong is mutually supportive. Whilst some industry professionals still see a great deal of competition, others from the industry appear to recognise that working together on certain elements of regulatory reform is likely to enhance the competitiveness of these centres.

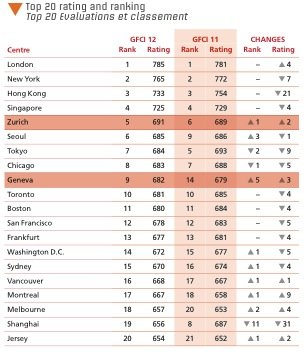

In GFCI 12, the top 10 included three European centres, three North American centres and four Asia/Pacific centres. Of these, only three centres, all European - London, Zurich and Geneva - saw their rating improved, with Zurich and Geneva also progressing in terms of ranking respectively to the 5th and 9th ranks. Seven centres experienced decliing ratings including all four Asia/Pacific centres. The past trend of large rises in ratings of Asia/Pacific centres appears to have stalled in GFCI 12. GFCI respondents believe however that Asian centres will continue to become more significant in the medium to long term.

Fig 1 - GFCI 12 top 20 financial centres

Zurich and Geneva have consistently featured in the top 15 financial centres since GFCI was first published in 2007. In GFCI 12 (September 2012), Zurich ranks 5th with an overall rating of 691 while Geneva ranks 9th with a rating of 683, displaying less than a 100 points difference with London, the world top financial centre according to the GFCI.

Zurich and Geneva are regarded as fairly stable and competitive financial centres globaly. When considering their evolution over time, both centres seem to follow a similar progression with the gap in ratings becoming smaller. When compared to the GFCI top four centres, Zurich and Geneva's ratings continue to rise while three of the top four centres - New York, Hong Kong and Singapore - saw their ratings decline since GFCI 11. For the latter two, this decline is part of a trend that has seen Asian centres including Hong Kong, Singapore, Tokyo, Shanghai, Beijing, Taipei and Shenthen stall or fall in GFCI 12. GFCI respondents indicate, however, that this trend is temporary.

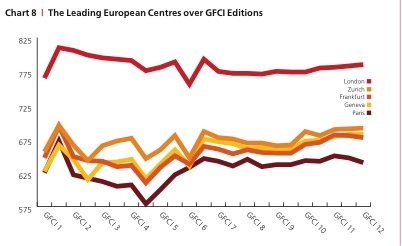

In Europe, Zurich and Geneva consolidate their positions as leading centres after London, whilst Frankfurt and Paris have fallen back slightly since GFCI 10 (September 2011) most likely due to the political uncertainty and the effects of the Eurozone crisis.

Fig 2 - GFCI 12 Leading European Centres

Switzerland as a good location for financial services

In Switzerland, the financial sector itself is a supporting pillar of the economy, generating nearly 11% of the national GDP and employing over 211,000 people.

Fig 3 - Switzerland key figures

Banks are the key players in the sector. Switzerland had 305 banks authorised by Finma at the end of 2012. Wealth management is at the core of Swiss banking activities. Historically, Switzerland gained prominence in wealth management during the 20th century thanks to the combination of a stable currency and economy, neutral policy and robust bank client confidentiality. At the end of 2011, Swiss banks managed assets totalling CHF 5,300 billion of which 51% belonged to foreign clients. Switzerland is indeed a leading player in cross-boarder private wealth management with a 27% share of the market. Three Swiss banks, including UBS and Credit Suisse, can be found in the top ten of the world's biggest wealth managers.

The second most important players are insurers. In 2010, 66% of their global premium income for private insurance and re-insurance was generated abroad indicating their high level of internationalisation. Swiss insurance companies have increasingly specialised in re-insurance making of Switzerland the fourth largest player in reinsurance in the world.

Switzerland is also a major player in currency trading, commodity trading and commodity trade finance as well as in the management of funds and hedge funds. Switzerland is often considered as a single financial centre, but financial services and activities take place primarily through five hubs - Zurich, Geneva, Basel, Ticino and Vaud. Of these, only Zurich and Geneva are currently included in the Global Financial Centres Index.

Zurich

Zurich is an internationally renowned financial centre and it has consistently ranked in the top 10 since GFCI was first published. In 2011, Zurich contributed to nearly half (47%) of the added value of the whole financial sector in Switzerland. Zurich is home to the Swiss Stock Exchange (SIX), one of the largest exchanges in Europe in terms of market capitalisation. The national exchange has operated since 1996 following the merger between Zurich, Basel, Geneva and Lausanne's exchanges.

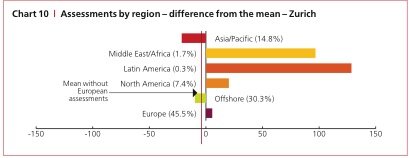

Fig 4 - Assessments by regions - difference from the mean - Zurich

Examining the assessments given to each major centre is a useful means of assessing the relative strength and weakness of their reputation in different regions. Zurich is generally well perceived and rated by GFCO respondents , scoring 721 on assessments in GFCI 12, up from 717 in GFCI 11. North American assessments of Zurich together with those from the Middle East & Africa are strong. Offshore and European respondents are much closer to the mean, while Asia/Pacific respondents are less favourable.

Geneva

Geneva has consistently ranked in the top 15 centres since the GFCI was first published. In 2011, Geneva contributed to nearly 13% of the value added by the financial sector nationally, making it the second financial centre in Switzerland. Geneva is a major player in wealth management and has become a strong contender in Commodity Trading and Commodity Trade Finance. With around 400 trading companies and over 8000 employees in this sector, Geneva is number one worldwide in grains and oil seeds, as well as cotton (tied with London) and is the leading centre in Europe for trading in sugar.

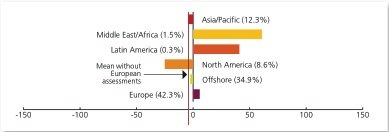

Fig 5 - Assessments by regions - difference from the mean - Geneva

Like Zurich, Geneva is generally well regarded by GFCI respondents and scores 709 on assessments in GFCI 12, up from 703 in GFCI 11. Geneva is given lower assessments by professionals based in North America and to some extent Offshore centres and Asia/Pacific. On the other hand, Geneva enjoys favourable assessments by professionals based in Europe, Latin America and Middle East/Africa.

Vaud

Lausanne/Vaud is the third financial centre in Switzerland, well regarded for its activities in wealth management and insurance services. Lausanne/Vaud is also specialised in capital risk, corporate finance and trade finance. The region also takes advantage of the numerous higher education institutions such as the University of Lausanne, IMD, the EPFL., GEC as well a the International Center for Financial Asset Management and Engineering.

Basel

Basel (town) is another major financial centre in Switzerland with financial activities accounting for nearly 5% of the value added of the sector at national level. Specialised in private banking, risk capital and insurance, Basel hosts the headquarters of UBS and of the Bank for International Settlements. In addition, it is where the Swiss Bankers Association was originally founded in 1912.

Ticino

Ticino is well known for wealth management activities especially with Italian clients that share a common language and culture. The centre has diversified its activities to include asset management and commodity trading. Ticino is increasingly contributing to Switzerland's significance in commodity trading with 70 operators active in metals (including steel), carbon and some soft commodities.