Balancing The Odds: Stochastic Accounting

By

Michael Mainelli and Ian Harris

Published by Balance Sheet, Volume 10, Number 2, MCB University Press, pages 22-27.

[An edited version of this article appeared as "Balancing The Odds: Stochastic Accounting", Michael Mainelli and Ian Harris, Balance Sheet, Volume 10, Number 2, MCB University Press (2002), pages 22-27.]

Abstract: The use of a deterministic numeric paradigm in auditing and accounting may well be the root cause of many current problems. This paper argues that risk-based accounting methods should start using probabilistic inputs which would show resultant distributions as output. “Stochastic accounting” would better inform users of financial information. Although this recommendation would change the way accounts were produced and presented, it would lead to more usable financial information.

Keywords: stochastic accounting, auditing, risk/reward management, probability distribution

If auditors practise risk-based auditing, then why can’t we see the odds they face? This simple question raises a number of concerns about the approach to financial statements and auditing by today’s accountants. The purpose of this article is to explore how “balancing the odds” might well give a truer and fairer picture of accounting than traditional ways of “balancing the books”.

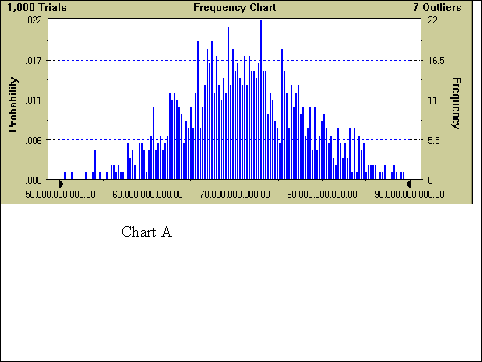

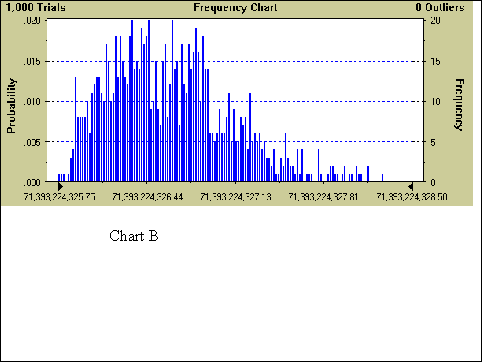

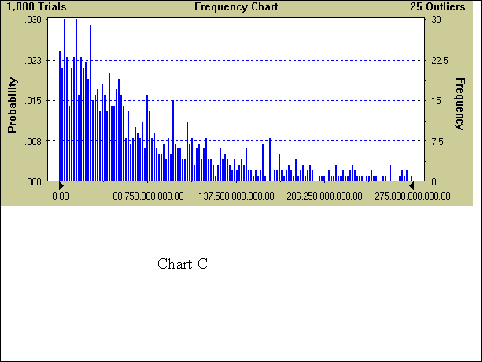

There is a surfeit of old jokes in which an accountant delivers the punchline, “What do you want the number to be?”. The uncomfortable truth is that accountants have quite a bit of influence over the final number. When Global MegaCorp states its turnover as £71,393,224,325.73 we know this number is a fiction. This is an estimate of the mean of turnover but we don’t actually have the distribution of values to know more. Realising the obvious absurdity and statistical improbability of purporting to know a huge corporation’s turnover to the penny, accountants laugh and happily round things off, but still neglect to give us any idea of the range of the distribution. One number alone is sought to describe complex distributions. The three frequency charts below all provide the same mean turnover, £71,393,224,325.73, under today’s deterministic, “one number” paradigm. However, that mean turnover has a very different meaning in each case.

Chart A below has an unbelievably large range: £50 billion to £90 billion, normally distributed around the above mean. There is a 90% likelihood that the turnover falls within the range £61 billion to £84 billion. The accountant is grappling with significant uncertainties when computing turnover. The auditor has materiality issues with the consequences of that uncertainty. Contrast Chart B, which has an insignificant range of possible outcomes. The accountant is grappling with rounding differences of pennies and the auditor couldn’t care less. Chart C is vastly different again. The distribution is heavily skewed, with the most likely outcomes being significantly lower turnover than the mean outcome (median turnover is £50 billion). There are possible outcomes at significantly higher turnover than the mean. All that you can say with 90% likelihood is that turnover falls within the range £0 billion to £172 billion. This is a nightmare for the accountant who is being asked “just give me the figure”. It is also a nightmare for the auditor trying to work out whether “the figure” is justifiable.

In the above cases, accountants and auditors will seek guidance from accounting standards, sometimes conflicting guidance, all in pursuit of a single number to describe the distribution. We recognise and understand the distinction between the roles of accountants and auditors, but also recognise that both draw on virtually the same intellectual frameworks and regulation, as well as sometimes being employed by the same organisations. There is a synergistic relationship with the accountant preparing financial statements and the auditor improving understanding by the accountant and increasing confidence for the user.

Goodwill Hunting

“The quality of information we now receive from companies in the U.S. is about the best we have ever seen and exceeds that of almost any other nation…” [Abby Joseph Cohen, Chair, Investment Policy Committee, Goldman, Sachs & Co., as quoted in the Financial Accounting Foundation (Financial Accounting Standards Board and Governmental Accounting Standards Board), Annual Report, 2000.]

Leaving aside topical, high-profile cases such as Enron, if Ms Cohen is correct then why do some of the following theoretical issues cause real-world problems?

- capitalisation of research and development, where assessments need to be made on the likelihood of a future revenue stream;

- intangible assets whose future value may fluctuate markedly, such as long-term contracts, patents, trademarks, and licensing agreements, must be recognized, valued, and amortised, yet this may not include all intangible assets—only intangible assets that meet certain criteria according to SFAS 141;

- handling pensions and health-care obligations where actuarial assumptions become crucial;

- executive stock options which may, or may not, be exercised under certain conditions;

- off balance sheet items which may have some effect, but are mostly off balance sheet.

The common thread is that the asset value and revenue implications of the above problems requires an assessment of future probabilities, not certainties. Even in aspects of accounting which we believe to be less contentious, where we are mainly using hindsight, similar concerns about future probabilities are involved. For example:

- inventory valuation relies on estimates of future sales and prices;

- work-in-progress needs careful handling of divergent assessments of earned value;

- numerous measures are marked-to-market, but through devices such as an annual average, e.g. interest calculations, foreign-exchange movements, which could have different results with different assumptions;

- using asset valuations every few years on big ticket items such as property assumes inherent stability in prices, yet even supertanker sales prices can fluctuate wildly and rapidly;

- all setting of reserves and provisions, e.g. bad debts, requires estimates of future outcomes.

The search for a single number is intertwined with debates of historic, current or fair value. Accountancy’s theoretical framework assumes a deterministic system which outputs a single number. In book-keeping, the focus on an exact single number is important. After all, what’s the point in trying to “balance the books” if “close enough” is adequate? Without the discipline of “balancing the books” lower-level mistakes would be missed and misunderstandings wouldn’t be cleared up. However, higher-level interpretations are probabilistic, i.e. inputs into a higher-level figure such as turnover include many sorts of estimate. Not everything can, or will, balance. Accountants need to move to a new theoretical framework where inputs are probabilities and outputs are distributions. At a very low level, book-keeping skills remain, but the interpretation and presentation of financial information needs to shift to distributions.

“For every difficult question, there is an answer that is clear and simple and wrong.” [George Bernard Shaw]

For want of a phrase for this theoretical framework, we use “Stochastic Accounting”. We contend that a single number for accounting terms such as turnover is “clear and simple and wrong”. As long as accountants continue to indulge this false simplicity, they will leave themselves exposed to misunderstandings of what they said and consequent misunderstandings of their roles in organisations. Actuaries, on the other hand, are used to reporting on a range of distributions. They tend to be clear about their “actuarial assumptions”. They do provide descriptive, single numbers about their actuarial forecasts, but the underlying paradigm is that they are reporting on distributions.

True and Fair Distribution of Financial Information

“Clearly, company management will have to learn how to deal with significant volatility in the balance sheet and, more importantly, in earnings.” [“Effects of Adopting IAS: 2002-2005”, Ernst & Young website, 2002]

If outputs from Stochastic Accounting are distributions, then they should materially affect the way financial statements look and feel. The structure of financial statements would remain similar to the three current, primary statements, viz. balance sheet, income statement (profit & loss) and statement of cashflows. However, the accountant would present three distributions as histograms for net assets, profit and cash. These distributions would be built up in turn from underlying distributions, e.g. in the case of assets – current assets, property, plant, equipment, investments, etc. A standardised reporting format might specify the presentation of the distribution and conventions on representing confidence levels, quartiles or standard deviations.

The auditor would check to ensure that the distribution functions presented are not materially different than his or her own. The auditor would perform sensitivity analysis on the distributions to determine where greater investigation would narrow the range at the same confidence level. Imagine the following two snippets of dialogue among an accountant, the finance director and their auditor:

[Accountant presents draft accounts to auditor and finance director]

Accountant: “Well, here they are. I’m 95% confident that Global MegaCorp’s profit is somewhere between losing £5 billion and making £20 billion.”

Finance director (spluttering): “What, is that the best we can do?”

Accountant: “Hey, that’s not so bad, you should have seen the numbers before I rechecked our fleet inventory.”

Auditor: “How tight do you need the numbers to be?”

Finance director: “Well, the analysts will expect us to have no greater than a £3 billion range, assuming we’re confidently into profit, say over £7 billion”.

Auditor: “That’ll cost, but we’ll get cracking.”

[three weeks later]

Auditor: “The sensitivity on work-in-progress directed me to spend almost 80% of our effort examining the state of some of Global MegaCorp’s largest construction projects, but I’ve managed to tighten the range to your required £3 billion, giving an estimated profit of £6.5 billion. Unfortunately, that has meant quite a bit of overspend on the audit, about £2 million. If you could in future live with say a £5 billion range, we can keep the costs down.”

Finance director: “A wide range this year will be a hard sell to the analysts, but we can probably do it. Next year’s profit looks to be much better, so this might be the time to start selling the analysts on a wider acceptable range.”

Better Sensitivity

During the dot.com era, accountants subjected themselves to needless criticism by putting forward business plans based on deterministic numbers which were incapable of showing the all-too-frequent reality - a chance to make lots of money and lots of chances to lose. Had accountants submitted plans which showed the distributions, they may well have served investors better, reduced unreasonable expectations and minimised criticism of the accountants’ role. Instead they presented single numbers or played with high, medium or low forecasts to calculate “average” forecasts, none of which contained the possibility of winding-up the business or wild success.

Risk-based auditing is another area where Stochastic Accounting might help. Over a decade ago we saw a large international accountancy firm’s proud introduction of a risk-based, audit software tool. Despite a lot of marketing press about a “risk-based approach to audit” and “advanced techniques”, risks were scored on a “high-medium-low” scale, not a number in sight. This was not an example of a sophisticated user interface because behind the scenes “high-medium-low” was converted into “3-2-1” and then added and averaged in a travesty of probabilistic risk. But the firm had no mechanism to apply anything other than a deterministic risk rating. The firm was unable to incorporate a distribution of possible outcomes into its working practices.

Some accountants would claim that things have moved on. Auditors will point out that they already use probabilistic techniques in establishing sample sizes. Without getting into a detailed debate on evidence in their working practices, e.g. do auditors perform Monte Carlo simulations to establish sensitivities, the crucial evidence of successful Stochastic Accounting would be the presentation of audited accounts in a probabilistic manner. Beneath that evidence we would expect to see methods which established input distributions, determined their interactions (e.g. sensitivity analysis, Monte Carlo simulations and some statistical calculations) and presented their impact in meaningful statements.

Fine in Theory

“In theory, there is no difference between theory and practice; in practice, there is.” [Chuck Reid]

Standard representations of distribution histograms will have to be specified. We also recognise that there will a strong movement to contrast and compare the shapes of distribution functions, i.e. characterise the location and variability of the dataset. Further standards of distribution function measures will have to be specified as well, to ensure accurate presentation. Alongside existing numerical descriptions of shape such as kurtosis or skewness, people will seek single number measures for comparison, e.g. riskiness. Z/Yen itself attempts to use a single number risk/reward ratio for comparing distribution functions with identical means in order to determine risk sensitivity. Z/Yen’s Risk/Reward Ratio is based on simple geometric principles giving for Chart A: 0.0, Chart B: 0.99, Chart C: 0.29, using £71 billion as the value point. Some of these measures may well help, particularly if they are calculated and presented in standardised forms, allowing users of financial information to input the parameters into analytical packages and obtain comparable distributions for further analysis. Perhaps the distribution datasets would be “downloadable” from the internet for those whose numerical interest goes beyond viewing standardised histogram representations.

We recognise there will be difficulty in acquiring information to determine distributions. Many firms have too little data to give any statistical validity to a distribution. However, much can be done to provide data through intra-firm comparisons, benchmarking or auditor input, e.g. what is a standard actuarial curve for bad debts in a given business sector. As it is the directors who must “prepare annual financial statements that give a true and fair view of the state of affairs”, in many cases, they will have to provide a qualitative distribution curve (in fact, quite a bit of software supports homemade distribution curves). If this seems artificial, in fact it’s quite the opposite. Which is worse, forcing directors to a single number, such as a guess-timated mean when none exists, or asking them to specify their views of the likely range of outcomes?

Some organisations will want to provide extremely wide ranges in their distributions. Where this reflects reality, so be it. In other cases managers will hope that a wide range removes some responsibility of meeting target. However, markets will punish managers who have not invested enough in gathering information to reduce uncertainty. Expect phrases such as “Global MegaCorp was punished today on release of its results, with a range for ROA of over 15% in an industry where 5% is the norm, much of this attributed to overseas licence problems…” There will also be a competitive force on auditors both from an increased ability to compare their previous years’ approvals with outcomes, and also from being known to be prone to wild ranges. Markets will transparently price the value of tighter distribution ranges.

If accountants are to move to a distribution paradigm, much work needs to be done, largely in three areas – commitment by the accounting establishment, restructuring of accounting training and communication to users of financial information. The starting point is an open debate about extending the conceptual framework of accounting to include stochastic concepts. This debate ought to lead to commitment from the accounting establishment by recognising that deterministic accounting is the root of many current problems. Stochastic Accounting is a change of perspective that resolves inconsistencies, not an attack on the foundations. Evidence of that commitment would be more presentations incorporating distributions rather than single points, a review of accounting standards (GAAP and IASC) to see where replacing a single number with a distribution would simplify statements and a review of audit methodology to change risk-based auditing to a more rigorous method based on quantitative evidence of estimation, not qualitative.

“The pure and simple truth is rarely pure and never simple.” [Oscar Wilde]

Getting out from under Depreciation

Accountants who suspect Stochastic Accounting is all too difficult for the users of financial information (a somewhat elitist conceit) might be surprised by a potentially warm reception. Competition for finance, greater integration of corporate finance with the business decisions and increased training in financial techniques on courses such as MBAs has heightened the financial awareness of many managers. In global corporations enterprise-wide risk/reward management systems are increasingly common. Enterprise-wide risk/reward management systems provide information on risk (or reward) and relate it to financial impact using probabilistic techniques. At the moment, these risk/reward managers are hampered by insufficient financial systems information. For instance, using a single deterministic number for valuing land may not help a risk manager assess the value of steps to reduce environmental contamination. Stochastic Accounting would integrate well with risk/reward management systems because the risk/reward managers would have the data they need to show the organisation how their efforts improve organisational value.

“The central role assigned to decision making leads straight to the overriding criterion by which all accounting choices must be judged. The better choice is the one that, subject to considerations of cost, produces from among the available alternatives information that is most useful for decision making.” [“Summary of Principal Conclusions”, Statements of Financial Accounting Concepts No. 2(FASB, May, 1980)]

Financial information is evaluated by its usefulness and understandibility in making financial decisions. Moving to Stochastic Accounting helps a number of the key characteristics of accounting information:

| Characteristic | Deterministic Problem | Stochastic Accounting |

|---|---|---|

| Relevance | ||

| predictive value | wide ranges require a single number | the range is fully described |

| feedback value | the single number is wrong 99.9% of the time and discussion centres on whether it was close enough | clear discussion on whether results fell within predicted ranges and if not, why was the certainty factor wrong |

| timeliness | much discussion and prevarication in choosing a single number | prompt presentation of the “way things are” and ability to see convergence over time |

| Reliability | ||

| verifiability (objectivity) | difficulty in obtaining consensus among different measurers | ability to incorporate different measurers when necessary |

| neutrality | difficulty in changing standards without affecting certain sectors, e.g. stock options and high-tech companies, or leases and property companies | reduction in the number of special standards needed to reflect practices in certain sectors |

| representational faithfulness | poor agreement between real world and measures | accurate reflection of real world phenomena |

The public are sceptical of the state of financial information produced by auditors and accountants, and by implication the accounting techniques upon which their work is based. Before accountants indulge in trendy ideas such as Triple Bottom Line reporting (corporate disclosure which integrates financial, environmental and social reporting), it might be better to straighten out the way in which they currently report, or risk further loss of public confidence. We believe that users of financial statements are ready to handle Stochastic Accounting. We believe that by presenting a true and fair view of distributions, accountants will gain respect by showing the complexity of the situation, rather than losing respect when a single point number turns out to be wildly inaccurate.

There are a number of old jokes that, “an actuary is someone who couldn’t handle the excitement of accountancy”. Until accountants adopt Stochastic Accounting, perhaps a more accurate paraphrase is that “an accountant is someone who couldn’t handle the honesty of being an actuary”.

Sources

“Objectives of Financial Reporting for Business Enterprises”, Statement of Financial Accounting Concepts No. 1, Financial Accounting Standards Board, 1978.

“Qualitative Characteristics of Accounting Information”, Statement of Financial Accounting Concepts No. 2, Financial Accounting Standards Board, 1978.

“Recognition and Measurement in Financial Statements of Business Enterprises”, Statement of Financial Accounting Concepts No. 5, Financial Accounting Standards Board, 1984.

“Elements of Financial Statements”, Statement of Financial Accounting Concepts No. 6, Financial Accounting Standards Board, 1985.

“Using Cash Flow Information and Present Value in Accounting Measurements”, Statement of Financial Accounting Concepts No. 7, Financial Accounting Standards Board, 2000.

Spiceland, J.D. and J.F. Sepe, Intermediate Accounting, Irwin/McGraw-Hill, 1998.

Inman, Mark Lee, “Towards a Conceptual Basis for Accounting”, ACCA Students’ Newsletter, June 1992.

Michael Mainelli (among other qualifications FCCA) originally did aerospace and computing research, before stooping to finance. Michael was a partner in a large international accountancy practice for seven years before a spell as Corporate Development Director of Europe’s largest R&D organisation, the UK’s Defence Evaluation and Research Agency, and becoming a director of Z/Yen (Michael_Mainelli@zyen.com).

Ian Harris (among other qualifications ACA) made a crucial decision in his youth winding up in accountancy rather than law. He spent a number of years writing humorous songs bemoaning his choice while advising his management consulting firm’s clients about mid-range and large-scale financial systems before co-founding Z/Yen with Michael (Ian_Harris@zyen.com).

Z/Yen Limited is a risk/reward management firm working to improve business performance through better decisions. Z/Yen undertakes strategy, finance, systems, marketing and organisational projects in a wide variety of fields (www.zyen.com), such as recent projects managing development of a client’s stochastic perception engine or the benchmarking of transaction costs across 25 European investment banks. Z/Yen practices stochastic accounting both internally and with clients. Michael and Ian’s humorous risk/reward management novel, “Clean Business Cuisine: Now and Z/Yen”, was published in 2000; it was a Sunday Times Book of the Week and even Accountancy Age has recently described it as “surprisingly funny considering it is written by a couple of accountants”.

[A version of this article first appeared as “Balancing The Odds:

Stochastic Accounting”, Balance Sheet, Volume 10, Number 2, MCB University Press (May 2002) pages 22-27.]